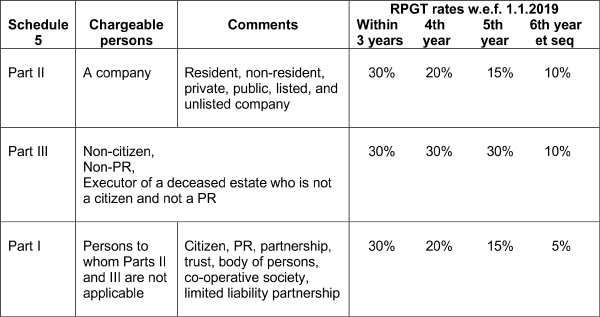

real property gains tax act 1976 amendment 2018

A The Fourth Amendment protects not only property interests but certain expectations of privacy as well. The Great Depression was a severe worldwide economic depression between 1929 and 1939 that began after a major fall in stock prices in the United States.

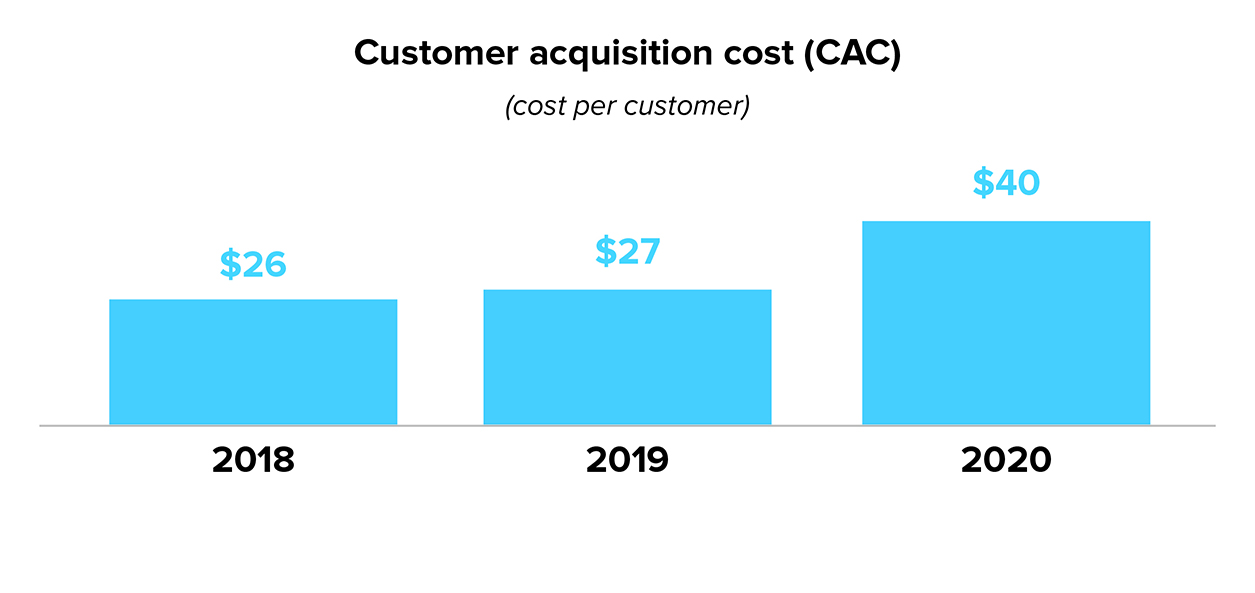

Key Changes In The Real Property Gain Tax Cheng Co Group

The combined tax rate of these two federal programs is 1530 765 paid by the employee and 765 paid by the employer.

. Amendment by section 1001d2B of Pub. For provisions that nothing in amendment by Pub. The economic contagion began around September 4 1929 and became known worldwide on Black Tuesday the stock market crash of October 29 1929.

929E Amends the Securities Exchange Act of 1933 the Investment Company Act of 1940 and the Investment Advisers Act of 1940 to expand SEC enforcement and remedies to include. A real property trade or business electing out of the limitation on the deduction for interest must use the ADS to depreciate nonresidential real property residential rental property and qualified improvement property. 2 2013 126 Stat.

In Anglo-American common law the party who entrusts the right is known as the settlor the party to whom the right is entrusted is known as the trustee the party for whose benefit the property is entrusted is known as the beneficiary. 23 2018 for purposes of determining liability for tax for periods ending after Mar. 98369 as to property placed in service by the taxpayer after May 23 1983 in taxable years ending after such date and to property placed in service by the taxpayer on or before May 23 1983 if the lease to the tax-exempt.

Amendment by section 31e of Pub. 100-647 effective except as otherwise provided as if included in the provision of the Tax Reform Act of 1986 Pub. Proposition 13 officially named the Peoples Initiative to Limit Property Taxation is an amendment of the Constitution of California enacted during 1978 by means of the initiative process.

Amendments Related to Title I of the Act - Permits a taxpayer to elect to have the amendment of the Tax Reform act of 1984 that defers the finance lease rules apply to any agreement. Thus when an individual seeks to preserve something as private and his expectation of privacy is one that society is prepared to recognize as reasonable official intrusion into that. 23 2018 for purposes of determining liability for tax for periods ending after Mar.

United States 389 U. 115141 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit taken into account prior to Mar. Again President Wilson made an appeal but on September 30 1918 the amendment fell two votes short of the two-thirds necessary for passage 53-31 Republicans 27-10 for Democrats 26-21 for.

The Taxpayer Certainty and Disaster Tax Relief Act of 2019 reduced the 2 excise tax on investment income of private foundations to 139. The amendments made by sections 1606 and 1607 amending this section and sections 46 172 and 443 of this title shall apply to taxable years ending after the date of the enactment of this Act Oct. 115th Congress Public Law 123 From the US.

The Amendment passed by two-thirds of the House with only one vote to spare. This section modifies the credit against the excise tax on wine for small domestic for 2018 and 2019 to. 501c and is one of over 29 types of nonprofit organizations exempt from some federal income taxesSections 503 through 505 set out the requirements for obtaining such exemptions.

Except that in the case of a taxpayer which has a net operating loss as defined in section 172c of the Internal Revenue Code of. B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not. 2 enforcement authority over any person who at the time of the alleged violation or abuse is or was a member or employee of.

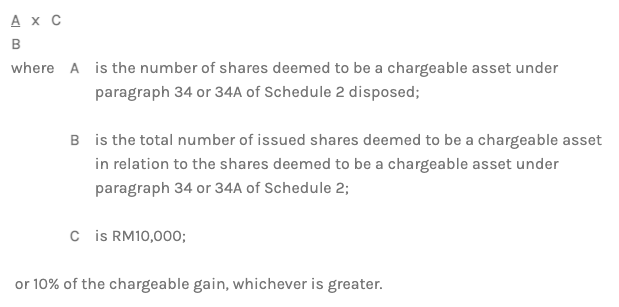

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for anothers benefit. A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. Paragraph 34A of Schedule 2 of the Real Property Gains Tax Act 1976 Continental Choice Sdn Bhd CB Ventures Sdn Bhd V.

In 20112012 it temporarily dropped to 1330 565 paid by the employee and 765 paid by the employer. Government Publishing Office Page 63 BIPARTISAN BUDGET ACT OF 2018 Page 132 STAT. The initiative was approved by California voters on June 6 1978.

111th Congress Public Law 203 From the US. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. 112240 title I 101a1 Jan.

Except that if less than 95 percent of the assets of such REMIC are real estate assets determined as if the real estate investment trust. 99-514 to which such amendment relates see section 1019a of Pub. 23 2018 see section 401e of.

501c26 - State-Sponsored High-Risk Health Coverage Organizations. 10716 901 which was repealed by Pub. A 501c organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code 26 USC.

The Winter of Discontent was the period between November 1978 and February 1979 in the United Kingdom characterised by widespread strikes by private and later public sector trade unions demanding pay rises greater than the limits Prime Minister James Callaghan and his Labour Party government had been imposing against Trades Union Congress TUC. The Tax Reform Act of 1986 repealed the exclusion from income that provided for tax-exemption of long-term capital gains raising the maximum rate to 28 percent 33 percent for taxpayers subject to phaseouts. 64 Public Law 115-123 115th Congress An Act To amend title 4 United States Code to provide for the flying of the flag at half-staff in the event of the death of a first responder in the line of duty.

The Social Security tax rates from 19372010 can be accessed on the Social Security Administrations website. Government Printing Office Page 1375 DODD-FRANK WALL STREET REFORM AND CONSUMER PROTECTION ACT Page 124 STAT. It was founded on April 1 1971 exactly six months before the opening of Magic Kingdom at Walt Disney World Resort in Bay Lake Florida just outside of.

And informally known as Disney Parks is one of The Walt Disney Companys five major business segments and a subsidiary. 1 nationwide service of subpoenas. Director General of Inland Revenue W-01A-275-042018 Case Report.

115141 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit taken into account prior to Mar. The economic shock transmitted across the world impacting. If your organizations name has been officially changed by an amendment to your organizing instruments you.

Many states refer to Section 501c for. For provisions that nothing in amendment by Pub. 100-647 set out as a.

The vote was then carried into the Senate. Each amendment made by this title amending this section and sections 24 32 55 and 63 of this title shall be subject to title IX of the Economic Growth and Tax Relief Reconciliation Act of 2001 Pub. 2315 was formerly set out as.

A regular or residual interest in a REMIC shall be treated as a real estate asset and any amount includible in gross income with respect to such an interest shall be treated as interest on an obligation secured by a mortgage on real property. Disney Parks Experiences and Products Inc formerly Walt Disney Parks and Resorts Worldwide Inc. Allows an income tax deduction for mortgage interest and real property taxes where a parsonage allowance or a military housing allowance has been received.

23 2018 see section 401e of. 1376 Public Law 111-203 111th Congress An Act To promote the financial stability of the United States by improving accountability and transparency in the financial system to end too big to fail to. Later in the 1980s Congress began increasing the capital gains tax rate and repealing the exclusion of capital gains.

98369 effective except as otherwise provided in section 31g of Pub.

Key Changes In The Real Property Gain Tax Cheng Co Group

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

Latest Amendments In Real Property Gains Tax Iqi Global

An Insight Into Real Property Gains Tax Rpgt Properly

Real Property Gains Tax Part 1 Acca Global

What Can A President Do During A State Of Emergency The Atlantic

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

Finance Bill 2021 Proposed Amendments To The Real Property Gains Tax Act 1976 Lexology

Social Security United States Wikipedia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Tm2135528d1 Ex99 1sp1img002 Jpg

2018 Virginia Building And Fire Code Related Regulations Icc Digital Codes

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Comments

Post a Comment